Publishing in the Age of Google AdTech Dominance

October 2023

#Monetization

Despite all the criticism the model receives, content supported by the digital advertising ecosystem is still the dominant business model of the Internet today. Within web publishing in particular, it is rare to find outlets that don’t utilize digital advertising as part of their revenue generation. Exceptions exist, but they are in a very small minority. It’s worrying then that so many of those outlets are reliant on a single company to fund their content and keep their operations buoyant. The company is, of course Google; a company with an almost legendary reputation for blocking publishers without notice.

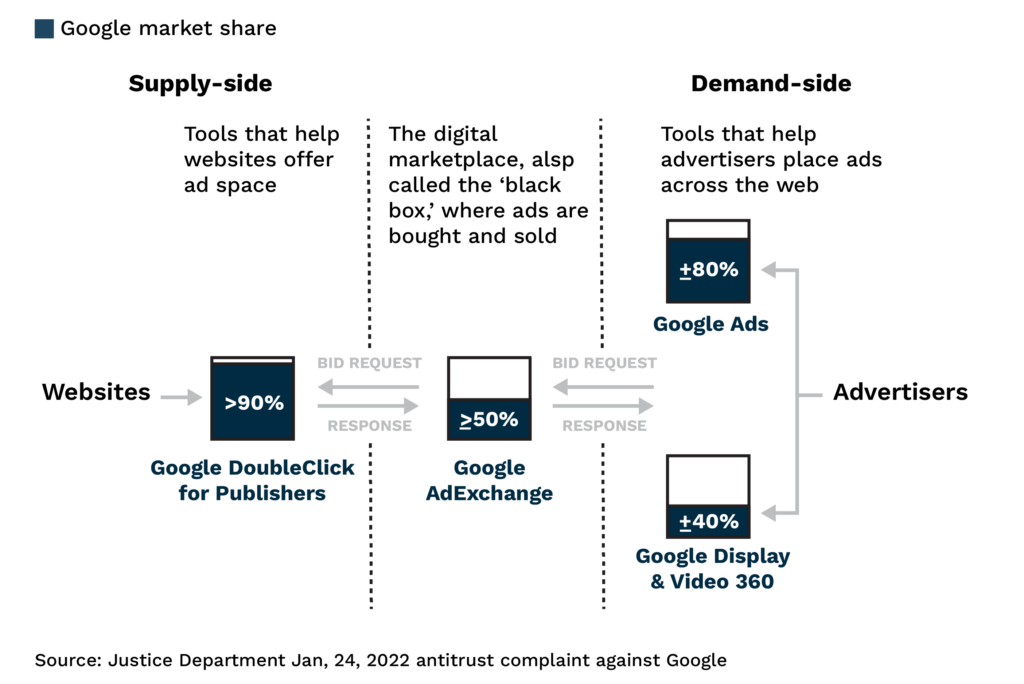

Google’s domination of digital advertising will not come as a surprise to many, but how dependent so much of the internet is on their advertising systems might. Many publishers selling their ad inventory through companies that seem like Google’s competitors are unaware of how large a proportion of their impressions couldn’t be filled if Google block-listed their domain. The intertwined nature of programmatic advertising means that Google touches a huge — and impossible-to-measure — proportion of impressions, through their involvement at every stage of the advertising value chain.

This diagram, from the 2022 American Justice Department antitrust complaint against Google shows just how involved they are:

This complete dominance of the space means the impact of being blocked by Google can be terminal for publishing businesses. Even businesses who have diversified their revenue away from Google can find other sources dramatically underperforming when Google steps back.

Why Google blocks publishers

Google has a swathe of policies for web publishers to abide by. When you sign up to serve ads from Google, or use any of their adtech, you are agreeing to those policies. A large proportion of those govern how the publisher serves ads so that Google has a consistent product that they can sell on to advertisers; stray outside of those rules and you risk being cut off.

Few would question the need to cut publishers out of the system when there is deliberate fraud happening, but the enforcement can sometimes seem harsh. Issues that can appear quite minor on a technical level can result in lifetime bans, and publishers can always be found online complaining about being banned “for no reason”. Of course, there is always a reason… even if the publisher doesn’t agree with Google about how serious it is.

From Google’s perspective, they are protecting the digital-advertising ecosystem. When an advertiser sees that the advertising they bought doesn’t match how it was described, they lose trust in the system. That doubt gets factored into the price they are willing to pay, and everyone suffers. When Google detects patterns like this, it gets labeled as invalid traffic. To some extent, it isn’t all that important whether that invalid traffic was deliberate or caused by oversight. Google’s priority is to prevent any adverse effects on paying advertisers, and the most effective way to achieve this is to stop ads serving through that publisher.

Google has definitely been working on making enforcement more publisher-friendly. Initiatives such as click-confirmations and improvements to the policy center have softened how accidental invalid traffic is handled. Ultimately, though, Google’s aim is to remove Invalid Traffic from their inventory — and the fate of one publisher barely factors into that process.

How Google impacts publishers

Google is the main revenue partner for a huge number of websites through the AdSense product. If those websites run afoul of Google policy, the impact is immediate and obvious: the money stops coming in. The impact of being blocked by Google goes further, though, than that first step.

The most-popular way to diversify ad revenue, and make a publisher less reliant on Google, is to use header bidding. Through header bidding, other partners are invited to bid on an ad request first. The winning bid is then passed to the ad server, and Google is given an opportunity to outbid the winner. Being blocked by Google obviously removes that final bid, and loses out on many of the highest-paying impressions. The double setback, though, is that Google’s huge advertising inventory means that it’s also what many publishers rely on for “fill.” Remove Google from the equation and you not only lose those high-paying impressions, but also the very large number of low-paying ones that would otherwise result in a house ad being shown.

Even when Google isn’t served into the stack, its omission has an impact. Many high-paying ad partners use Google as part of their own stack – applying upward auction pressure and keeping advertisers paying closer to their top bid. Remove that pressure, and prices collapse. Finally, let’s not forget that the most-popular ad server in the world is Google Ad Manager, and access to GAM is reliant on having a Google publisher account. Lose the account, and your entire ad stack can stop working.

Google is also dominant on the demand-side. Having your domain blocked by Google Ads or DV360 isn’t usually as dramatic as being blocked by the supply-side technologies, but it comes with an extra problem: It can be hard to spot. If Google’s demand-side tech blocks your domain or ad units you won’t even be notified — and many set-ups make this difficult to spot unless it is being specifically looked for. The publisher just sees a hard-to-explain drop in overall performance.

Ad revenue suddenly drying up can be terminal for publishers. Ad revenue pays the bills, and pays for the content that publishers create. When ad revenue stops, it can trigger a rapid downward spiral.

(Are you looking for new ways to turn engagement into revenue? Learn more about content engagement tools here.)

How to stop this happening to you

As the old saying goes, “An ounce of prevention is worth a pound of cure” — so what can publishers do to build resilience against these risks?

- Diversify

A major goal for many publishers is to be less-reliant on Google for ad income. Header bidding is an obvious first step, which will broaden sources of income, but it’s worth considering revenue from outside of the ad server, too: subscriptions, paywalls, sponsorships, affiliates, etc. Build income that keeps the lights on even if the ad server gets turned off. - Understand policy and the risks

Whoever is making decisions around ad placement and ad implementation should understand the policies, and the risk of operating outside of them. Too many publishers are guided by what they see as “normal” rather than the letter of the policy. - Monitor

It is the publisher’s responsibility to monitor what is happening with their ad implementation, and take action if there is a problem. Reliably spotting and understanding changes in performance is key to long-term ad success.

What’s next?

The US Justice department investigation cited earlier is just one of many investigations into Google’s adtech dominance happening around the world. Many governments and legislators are clearly concerned that their dominance has gone too far, and some are pushing for Google to be broken up.

The potential consequences of any antitrust action against Google could be vast and varied. In the most extreme scenarios, Google could be forced to divest from some of its many ad technology services, leading to a potential reshaping of the online-advertising industry. However, it’s also possible that only minor adjustments may be made to Google’s business practices, resulting in little overall change for the publishers who rely on their services.

Regardless of the outcome of these investigations, what is clear is that the digital publishing industry is facing a period of potential disruption and change. If Google’s ad dominance were to be significantly reduced, publishers could find themselves needing to adapt quickly to a new advertising landscape.

On the one hand, reduced reliance on a single company could lead to greater resilience and sustainability in the sector. Publishers might have to diversify their ad revenue sources, as suggested above, which could in turn lead to a more balanced and competitive advertising marketplace. On the other hand, the transition could be difficult for publishers that are currently heavily dependent on Google’s services.

Final thoughts

In a landscape where one company holds such a substantial sway over the digital advertising ecosystem, it’s understandable why publishers might feel apprehensive about the possibility of sudden changes. Yet, while Google’s dominance is undeniable, it is also essential to remember that this dominance isn’t necessarily permanent.

As with any industry, change is inevitable. A good example is the seismic shift that is the end of third-party cookies, which is coming for the prepared and unaware alike in 2024. Such a structural change to how so many do business online is bound to affect even the big kids on the playground; whether these changes will be beneficial or harmful for publishers remains to be seen. What is certain, though, is that publishers need to be prepared for these changes.

Diversification, understanding policy and risk, and effective monitoring will be key components to weather the changes that are coming. Publishers need to be nimble and proactive, rather than reactive, to ensure they can navigate the shifts in the advertising ecosystem. Ultimately, the future of the digital advertising ecosystem will depend on how well publishers can adapt to these changes and find new ways to monetize their content in a post-Google-domination world.

Written by